Financial literacy still lacking in Uganda, says UFLA

Whereas financial literacy has become a key element around the world, experts say Uganda is still lagging behind in this component of financial reform.

“There is a lot of money being dished out by both government and development partners in their efforts to reduce poverty and empower the population but unfortunately, this money is being dished out people who have no idea of how to manage it,” Daniel Ayebare, the chairperson of the Uganda Financial Literacy Association(UFLA) said.

Keep Reading

“ Take an example of the Parish Development Model and someone deep down in the village has never held shs100,000 and you give them shs1 million, the excitement alone makes then run mad and end up using the money to buy alcohol or take it in betting away from the original plan.”

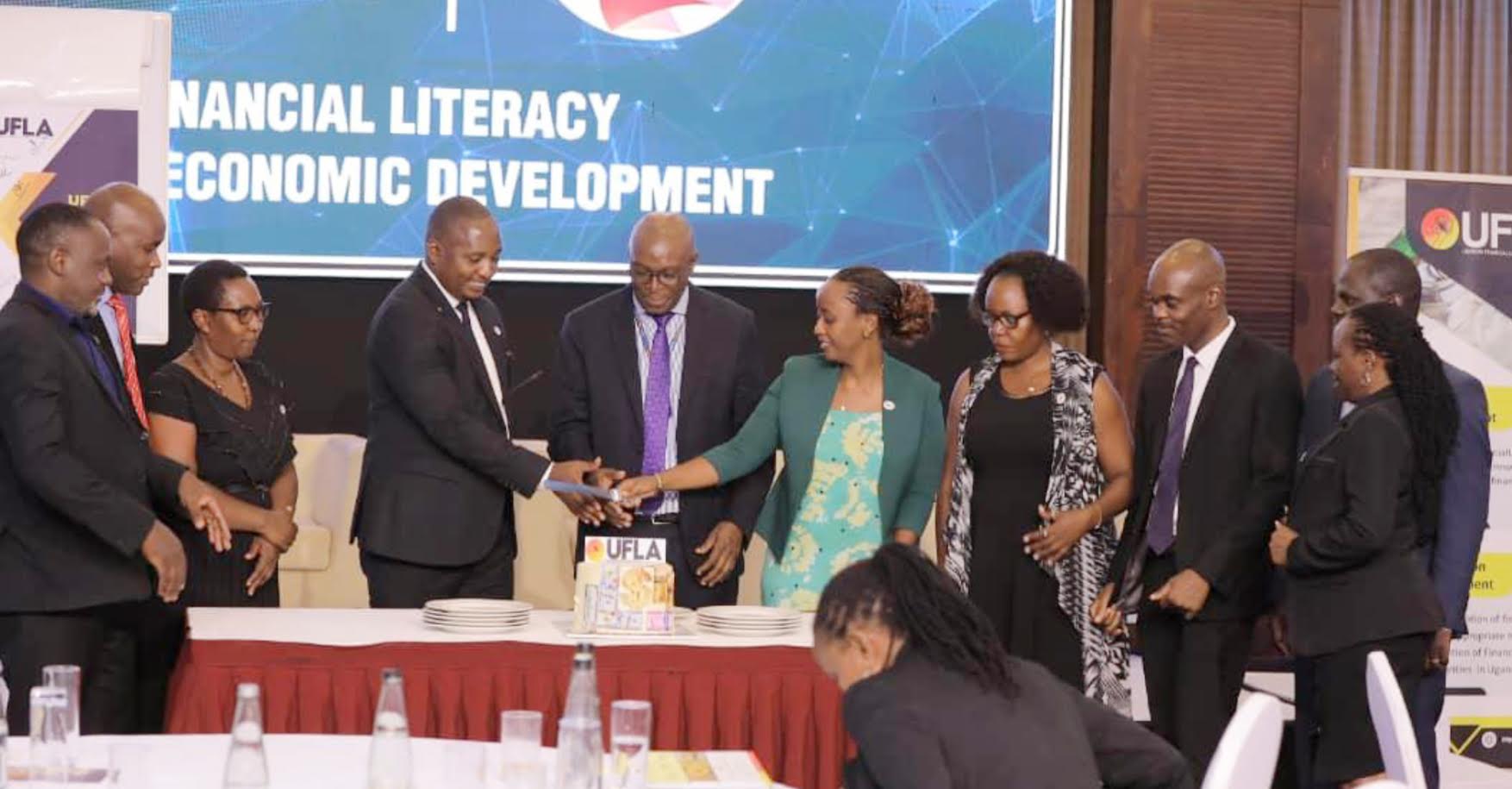

Ayebare was on Thursday speaking as UFLA celebrated its first anniversary but also launched its strategic plan for the next three years at an event held at Kampala Serena Hotel.

Ayebare said it would have ben prudent that before any programs starts, government first considers teaching beneficiaries how to handle and grow their finances.

“The idea should have been is that these people are trained first on handling money before the money is actually disbursed.”

“Even when you check statistics about mental health, money is 100% involved. If you give your money to a child who has no idea how to use it, the first thing they will go for is alcohol or waste it an in the long run, this child will get mental issues. Men are actually running made because they are failing to manage their families. In general, one can see that 90% of stress for Ugandans is money related. This is because of lack of financial literacy among most Ugandans.”

He insisted that this is not only limited to the illiterate and those in rural areas but mostly corporates.

“We have seen a number of people who are heavily indebted and stressed because of a lack of financial discipline.”

The Ministry of Finance Permanent Secretary, Ramathan Ggoobi underscored the role of financial literacy for the growth of the economy.

“Financial literacy initiatives help people understand concepts like saving. If people increase the amount they save, they are able to invest in their farms and businesses, which can generate wealth, create jobs and boost productivity. If people save in financial institutions, such as banks, their savings can be pooled and used to provide finance for business innovation and expansion. This can lead to increased capital formation, which is essential for economic growth,” Ggoobi said.

“Financial literacy goes beyond the basic understanding of budgeting and saving; it encompasses the knowledge and skills necessary to make informed financial decisions and protect oneself from potential risks, including the ever-growing threat of financial fraud. In an era dominated by digital transactions and complex financial instruments, the importance of financial literacy cannot be overstated.”

To this, he said government has undertaken a number of reforms and initiatives aimed at increased capital formation, which is essential for economic growth .

He cited the Parish Development Model program in which one of the key pillars is financial literacy, aimed at ensuring the populations makes informed financial decisions.

Nevertheless, according to the Uganda Financial Literacy Association chairperson,Uganda has made great strides in terms of financial literacy in the past 10 years.

“In the last 10 years, Uganda has taken the leadership role in the region in terms of financial literacy programs to reach out to the last person . BoU has been able to go across Kenya, Tanzania and even Rwanda to work with the central banks there to ensure they can implement the financial literacy strategy we have here,” Ayebare said.

He noted that the Uganda Financial Literacy Association is soon following up on what has been done by the BoU to leverage their networks to build content and systems to bring the population to the right financial literacy capabilities.